Primary audience on the website are SP52948 owners (current and previous), tenants, investors, and potential buyers in strata complex.

Number of SP52948 owners, tenants, and investors expressed gratitude towards this website as that was the only way to gain access to lot of critical information, which is not available in minutes and notices of meetings, or on Waratah Strata website.

Public is voicing strong concerns about problems with Tribunals. Issues with strata complexes and dubious quality of services provided by those who should enforce laws are common and frequent.

The rest of the audience is anyone who might be interested in problems with strata schemes in NSW...

Democracy should be the leading avenue for managing strata complexes. But, democracy requires high level of sense and ethics, and right for all owners to have full access to strata files in order to make informed decisions. And when that does not happen, how to proceed? One way is to educate public and rise awareness that license to be a strata manager is one of the easiest in any industry: Strata Community Australia (SCA) are offering a three-day course on qualifying to be a strata manager with no prior educational requirements (apparently educational requirements are fulfilled by completing the course).

Major news on 14 May 2025: strata manager Michael Lee, featured in the Strata Trap report on ABC TV’s Four Corners, was the first in NSW to be banned for life from operating as a strata manager. Lee was also been fined $11,000, his company, Result Strata Management, had its licence cancelled and it fined $22,000. Lee who was just three days from the end of a four-month suspension issued in January, was the first strata manager in NSW to be “struck off” purely for the way they conducted their business. Lee was featured in the ABC report using hired “security” to prevent owners from entering the AGM to vote against him and his committee. Lee, an owner in the building, was its strata committee chairperson as well as its strata manager. After a long-running investigation, Fair Trading found that, under Lee’s direction, the company had failed to disclose conflicts of interest, consistently breached rules of conduct, charged fees for services not rendered, and failed to ensure that owners’ properties complied with critical fire and safety obligations. In addition, it did not provide information to owners when required, acted contrary to instructions given at general meetings, and failed to make sure a building had adequate insurance cover. As a result, he became the first strata manager to be banned for life.

Examples of legal cases terminated contracts with strata and building managers in Australia

The owner of the website was exposed to multiple threats and indimidation tactics by BCS Strata Management (until 31 January 2017) and Waratah Strata Management (since 1 February 2017), which included unsuccessful defamation attempts, false statements to owners in notices of the meetings, prevention of access to SP52948 strata documents (and even Strata Rolls), preventing the owner from conducting duties of committee member whilst allowing unfinancial owners to do it, supported verbal threats, stalking, and intimidation of the owners, and refusal to attend free mediations at NSW Fair Trading, whilst providing false statements to CTTT and NCAT through the same Solicitor.

There is no website which covers more detailed events related to strata issues with direct evidence than this one in Australia (trust through verification).

This website does not have any desire or intent to add own comments and therefore it is up to anybody to make up their own conclusions based on evidence and statements by others who did it in public forums, in courts, or elsewhere. All files on this website were provided to Fair Trading NSW, Office of Legal Services Commissioner, CTTT (now NCAT), District Court, Supreme Court, and Police.

Justice McCallum publicly stated:

Extensive media reporting of allegations of criminal conduct is not a mischief in itself. On the contrary, it is appropriate to recognise that the media play an important role in drawing attention to allegations of criminal or other misconduct and any shortcomings in the treatment of such allegations.

Due to long-term abuse of insurance premiums by Waratah Strata Management, whilst obtaining significant insurance commissions (personal benefits to strata agency), that did not benefit owners corporation, there was a NSW Fair Trading Mediation case 00994497 scheduled for SP52948 on 18 November 2024, which Waratah Strata Management and committee members declined to attend. One of the items was:

SSMA 2015 Section 238 (b) - Orders prohibiting strata manager and committee to make certain decisions without general meetings: Revoke authority for strata manager to renew insurance on behalf of owners corporation without decision at legally-convened meetings, and revoke authority for strata manager to renew or sign any major contract on behalf of owners corporation (utilities, elevators, painting, major maintenance and upgrades).

As of early September 2025, insurance commissions were paid to Waratah Strata Management in amount of $71,536.69 since 2018 with evidence of previous strata agency BCS Strata Management not allowed to receive insurance commissions due to conflict of interest.

One of good initiatives by ex-Chairperson Bruce Copland was to disallow strata agencies to claim rebates and commissions for insurance renewals, as listed in his submission to CTTT on 10 March 2012. After Waratah Strata Management took office on 1 February 2017, they started receiving significant rebates and commissions for insurance renewals:

-

Australia's largest strata insurance broker has been caught misleading its clients, burying an offer of cheaper insurance from a rival company, and instead recommending a more expensive policy from its own wholly owned firm. The revelation — described as "of concern" by the Australian Competition and Consumer Commission — lifts the veil on the growing power of Steadfast Group, a $7 billion publicly traded insurance giant. Steadfast and its subsidiaries have deals with some of the country's largest strata firms, including PICA, which has more than 200,000 lots under management, and Bright & Duggan, which manages schemes containing 85,000 apartments and townhouses.

In March 2024, ABC also exposed the exorbitant fees and secret kickbacks that had long been received by one of the country's most high-profile strata firms, Netstrata. As a result, the company's boss, Stephen Brell, was forced to stand down from his position as the NSW president of the industry peak body, the Strata Community Association, and authorities established an inquiry into his firm's practices.

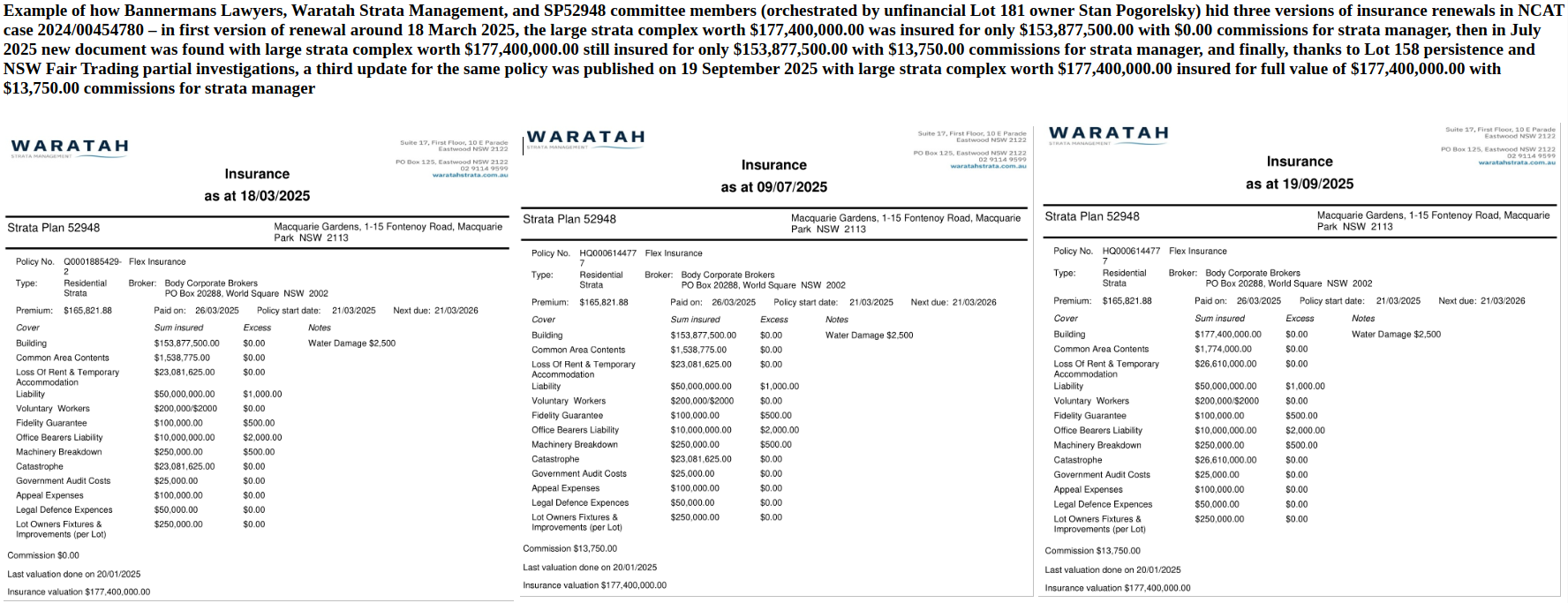

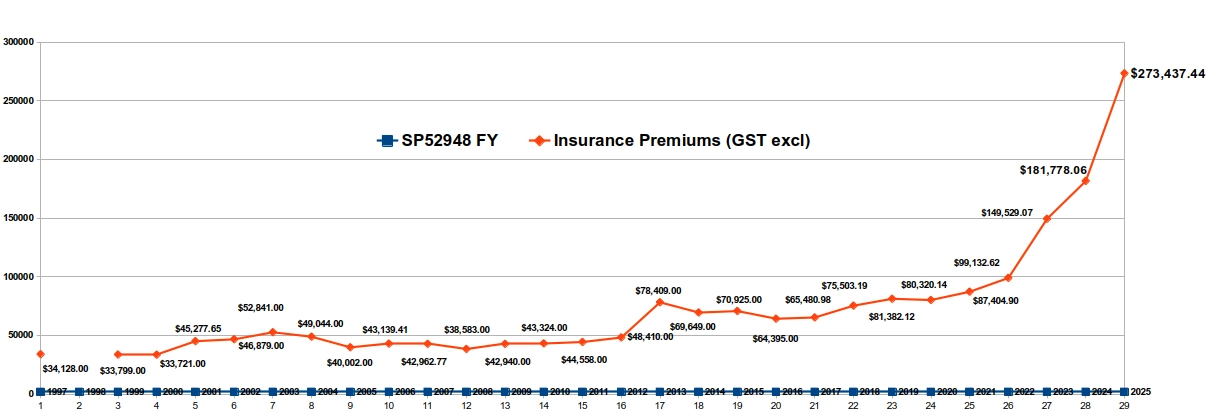

- Status of insurance premium changes since 1997 (Waratah Strata Management took office on 1 February 2017 without competitive tender at AGM 2016):

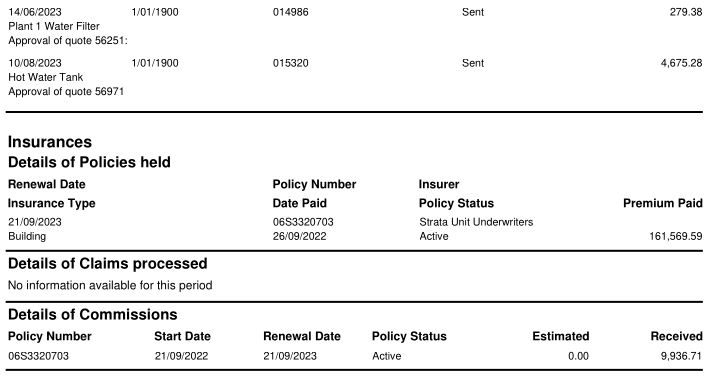

SP52948 Financial Year Insurance Premiums (GST excl) Difference to previous year Comments and insurance commissions paid to strata manager (important note: BCS Strata Management acquired Raine & Horne Strata Management in 2010, so it is effectively the same company since 1999) 1997 $34,128.00 Bright & Dougan 1998 Undeclared by MDA Strata Services 1999 $33,799.00 0.00% Raine & Horne Strata Management 2000 $33,721.00 -0.23% $5,145.34 was paid to Raine & Horne Strata Management 2001 $45,277.65 34.27% $5,428.07 was paid to Raine & Horne Strata Management 2002 $46,879.00 3.54% Raine & Horne Strata Management 2003 $52,841.00 12.72% Raine & Horne Strata Management not allowed insurance commissions 2004 $49,044.00 -7.19% Raine & Horne Strata Management not allowed insurance commissions 2005 $40,002.00 -18.44% Raine & Horne Strata Management not allowed insurance commissions 2006 $43,139.41 7.84% Raine & Horne Strata Management not allowed insurance commissions 2007 $42,962.77 -0.41% Raine & Horne Strata Management not allowed insurance commissions 2008 $38,583.00 -10.19% Raine & Horne Strata Management not allowed insurance commissions 2009 $42,940.00 11.29% Raine & Horne Strata Management not allowed insurance commissions 2010 $43,324.00 0.89% BCS Strata Management not allowed to receive insurance commissions 2011 $44,558.00 2.85% BCS Strata Management not allowed to receive insurance commissions 2012 $48,410.00 8.64% BCS Strata Management not allowed to receive insurance commissions 2013 $78,409.00 61.97% Two insurers declined to quote due to high risks, four insurance claims for Solicitor Adrian Mueller (strong evidence includes false statements by BCS Strata Management in Statutory Declaration to CTTT on 19 April 2013, false statement in Affidavit to District Court on 31 January 2014, four different versions of the same Standard Costs Agreement with Solicitor Mr. Adrian Simon Mueller, secret change of the insurance policy for SP52948 and then claiming amount of $24,919.31 (plus GST) for non-existent "defence" of Lot 3 in CTTT case SCS 12/32675 without owners corporation disclosure or decision at any general meeting, false written statements to CTTT by selective committee members, CHU Insurance forced partial repayment in amount of $8,800.00 in 2017). BCS Strata Management not allowed to receive insurance commissions 2014 $69,649.00 -11.17% BCS Strata Management not allowed to receive insurance commissions 2015 $70,925.00 1.83% BCS Strata Management not allowed to receive insurance commissions 2016 $64,395.00 -9.21% BCS Strata Management not allowed to receive insurance commissions 2017 $65,480.98 1.69% BCS Strata Management not allowed to receive insurance commissions 2018 $75,503.19 15.31% $6,570.16 paid to Waratah Strata Management 2019 $81,382.12 7.79% $6,084.84 paid to Waratah Strata Management 2020 $80,320.14 -1.30% $5,633.62 paid to Waratah Strata Management 2021 $87,404.90 8.82% Solicitor Adrian Mueller fully involved in forcing insurance claims for his alleged work. $6,541.55 paid to Waratah Strata Management 2022 $99,132.62 13.42% Insurance claim for Solicitor Adrian Mueller (on 25 March 2022 Waratah Strata Management listed revenue from insurance claims in amount of $19,758.14. Insurance broker forced SP52948 to pay extra $1,617.37 (GST incl) as per invoice on 9 August 2022 for overdue excesses dated 20 September 2021 and 19 April 2022. SP52948 was forced to repay $4,545.45 (GST excl) to insurance company for Solicitor Adrian Mueller’s legal costs in NCAT case SC 20/33352. $6,541.55 paid to Waratah Strata Management 2023 $149,529.07 50.84% Insurance renewal was due on 21 September 2022 but paid on 26 September 2022 (creating risk of uncovered common property for period of five days). SP52948 was at high risk due to expired insurance. SP52948 was forced to repay $15,200.15 (GST excl) to insurance company for Solicitor Adrian Mueller’s legal costs in NCAT case SC 20/33352. SP52948 was underinsured (property valued at $146,550,000.00 was underinsured by $16,937,850.00 for catastrophe events). $6,541.55 paid to Waratah Strata Management 2024 $181,778.06 21.57% Insurance renewal was due on 21 September 2023 but not listed on Waratah Strata Management even as late as 11 October 2023. Economos Auditor signed the accounts on 21 October 2024 and reported insurance premium as $183,181.00. $9,936.71 paid to Waratah Strata Management 2025 $122,690.28 (covering only half-year period!) 34.98% Insurance renewal was due on 21 September 2024 but not listed on Waratah Strata Management until 23 October 2024. Insurance renewed only for HALF-YEAR period (until 21 March 2025) due to lack of funds in Admin Fund and HIGH legal risks. Insurance company warnings in their policy on 24 September 2024: “Building Defects - Additional policy exclusion Building Defects and remedial work exclusion (applicable to all sections). We will not pay any claims for Damage, Personal Injury, Property Damage, Loss, or legal expenses caused directly or indirectly by, contributed by or arising from any of the defect in any item, structural defect, faulty design, faulty workmanship error or omission as outlined within the report issued by Fire and rescue NSW dated 08/11/2019 and any subsequent reports. Risk Survey - Cover under this policy is subject to a Risk Survey being conducted by Strata Unit Underwriters and implementation by the insured of any suggested risk improvements within 60 days of request. Should the insured not make the reasonable suggested risk improvements within 60 days of request, and should the Risk Survey of the premises show an increased risk of loss, damage or liability in relation to the premises, Strata Unit Underwriters may charge an additional premium, change the cover of your policy and/or impose special conditions to reflect the increased risk of loss, damage or liability. Strata Unit Underwriters may also cancel the policy if permitted by the Insurance Contracts Act 1984 (Cth). It is important for the insured to know that Strata Unit Underwriters may make changes to this Policy as a result of a change in the insured’s information. When there is a change, Strata Unit Underwriters will inform you. If the insured is not satisfied with the changes, the insured may cancel the policy.” $9,936.71 paid to Waratah Strata Management in spite of advance warning to executive committee not to allow it 18 March 2025 Document published on 18 March 2025 claimed that insurance premiums were paid on 26 March 2025 (future date!?) in total amount of $165,821.88 (GST incl). Like in FY 2023 (year ending on 31 August 2023), where SP52948 was underinsured (property valued at $146,550,000.00 was underinsured by $16,937,850.00 for catastrophe events), similar was done in March 2025. SP52948 was underinsured (property valued at $177,400,000.00 was insured for only $153,877,500.00). Waratah Strata Management allegedly did not receive any commissions, although they had published resolution in Motion 14 for AGM on 28 November 2024 that owners "acknowledged commissions and training services estimate at less than $100.00 per person per year", amounting to around $21,800.00 (for public record, Waratah Strata Management failed to declare insurance commissions in agenda for AGM 2024). On 4 July 2025 new insurance policy for the same renewal was found which listed insurance commissions as $13,750.00. $23,686.71 paid for insurance commissions to Waratah Strata Management in spite of advance warning to executive committee to not allow it 26 March 2025 $150,747.42 (covering one year period which includes half of FY 2026 without owners’ approval or disclosure). Total cost: $273,437.44 41.46% (covering FY 2025 only - one-year period, to ensure same calculations) Document published on 26 March 2025 claimed that insurance premiums were paid in total amount of $273,437.44 (GST excl). Waratah Strata Management allegedly did not receive any commissions, although they had published resolution in Motion 14 for AGM on 28 November 2024 that owners "acknowledged commissions and training services estimate at less than $100.00 per person per year", amounting to around $21,800.00 (for the public record, Waratah Strata Management failed to declare insurance commissions in agenda for AGM 2024). On 4 July 2025 new insurance policy for the same renewal was found which listed insurance commissions as $13,750.00. $23,686.71 paid for insurance commissions to Waratah Strata Management in spite of advance warning to executive committee to not allow it 19 September 2025 $10,707.92 N/A Thanks to Lot 158 investigations, under pressure from NSW Fair Trading, Waratah Strata Managemnt organised urgent insurance increase for property valued at $177,400,000.00 Graph of insurance premium changes since 1997, (Waratah Strata Management created complex structure with two insurance renewals for FY 2025 (in September 2024 and March 2025), without legally compliant meetings and not declaring their commissions in agenda for AGM 2024 and EGMs in 2025:

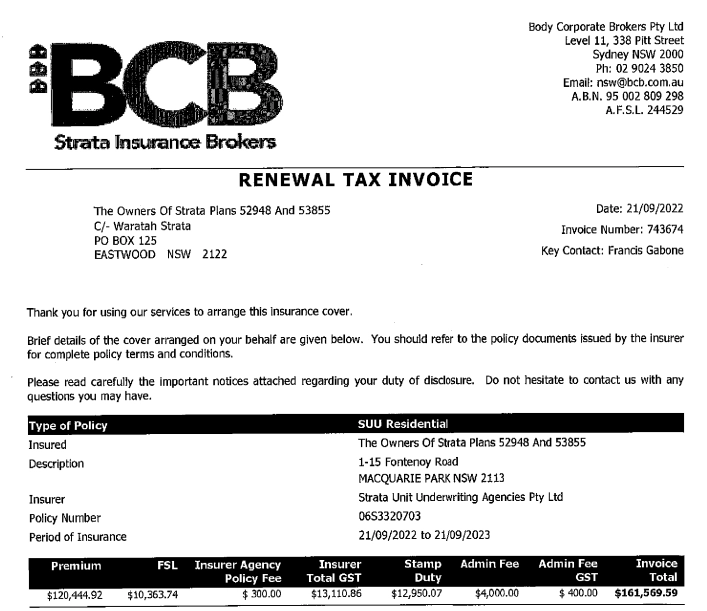

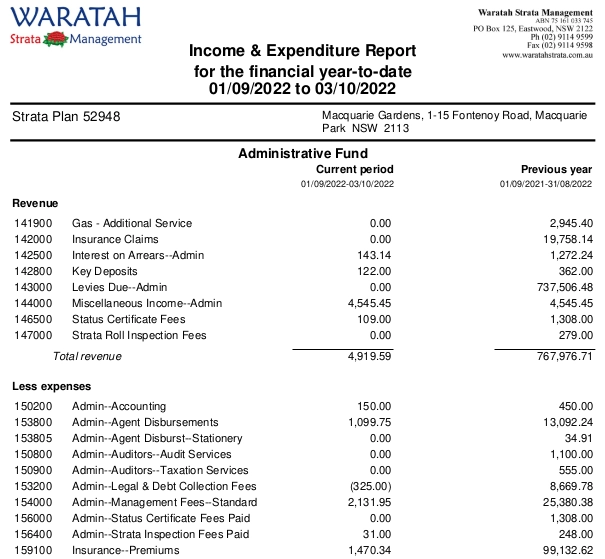

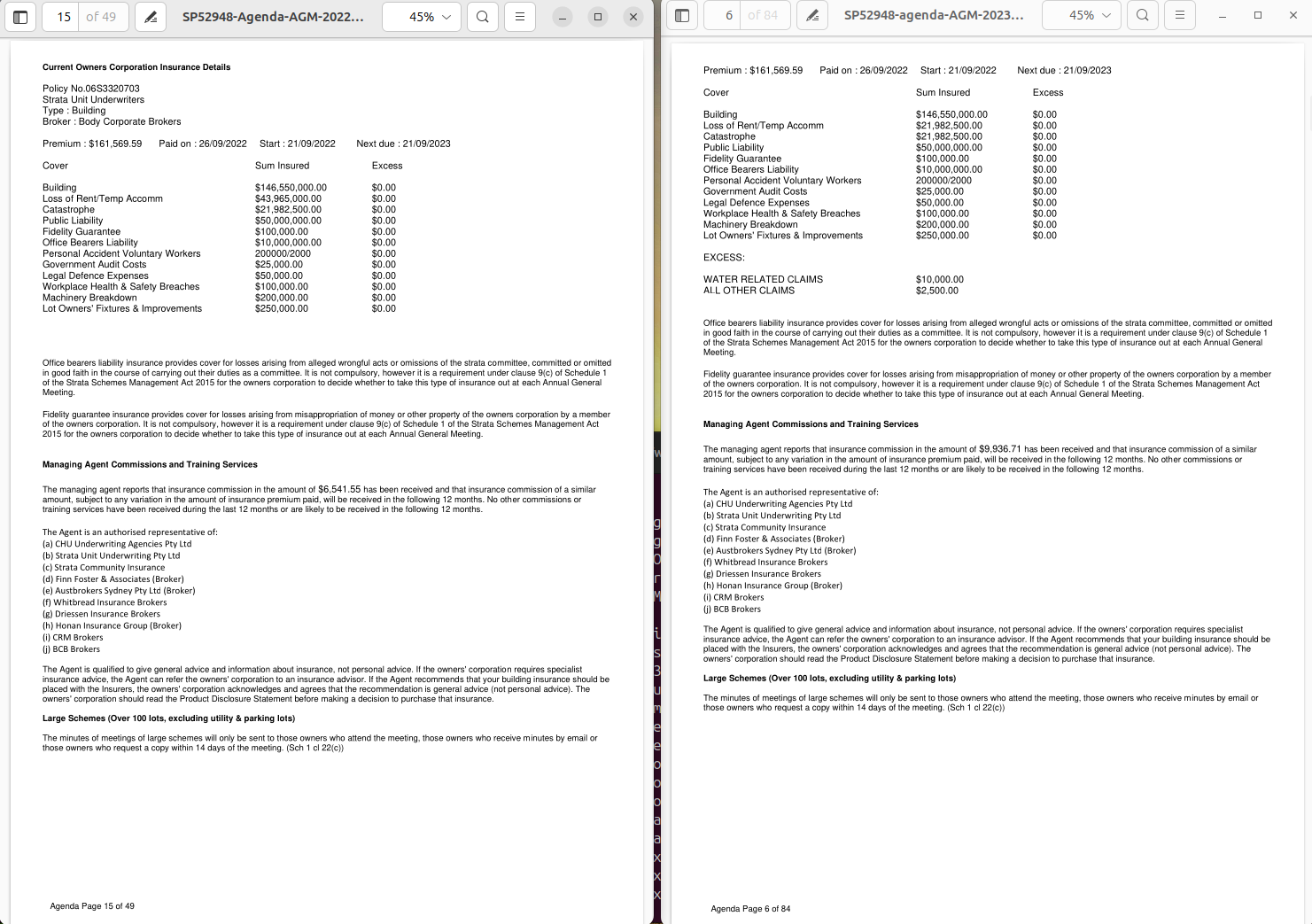

In FY 2023 (year ending on 31 August 2023), insurance premiums increased by significant amount of 50.84% (from $108,193.26 in 2021 to $161,569.59 in 2022 - all GST inclusive), without disclosure to owners, while as of 3 October 2022 Income & expenditure Report still did not list any payments for insurance policy:

SP52948-underinsured-large-strata-complex-for-catastrophe-events-FY-2022

On 21 September 2022, insurance premiums increased by significant amount of 50.84% (from $108,193.26 in 2021 to $161,569.59 in 2022 - all GST inclusive), without disclosure to owners, while as of 3 October 2022 Income & expenditure Report still did not list any payments for insurance policy:

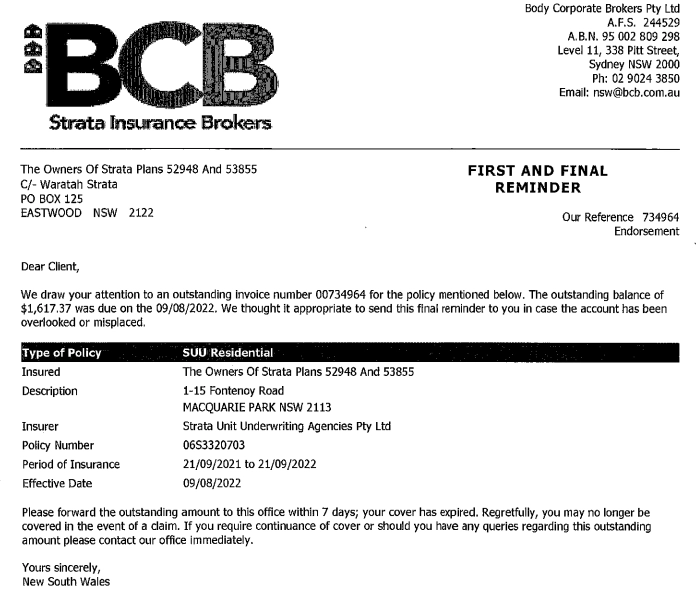

Waratah Strata Management did not disclose to owners that they might have delayed additional payments (excesses) for insurance policy due on 9 August 2022, as shown in reminder sent by BCB insurance broker:

Detailed Expenses for FY 2022 (1 September 2021 to 31 August 2022) shows that Waratah Strata Management might have failed to pay excesses for two events on time, dated 20 September 2021 and 19 April 2022, which were listed in BCB insurance broker reminder in August 2022, with warning about expired insurance. The dates of payments for insurance excesses in Detailed Expenses for FY 2022 were questionable, unless BCB insurance broker made a mistake with the letter in August 2022. As an example, no insurance excess was listed in code 169400 in Income & Expenditure Report on 28 September 2021 at 08:47 hours. Waratah Strata Management did not list any insurance claims in FY 2022, as shown in Delegated Functions Report dated 7 October 2022 at 17:46 hours:

The reminder highlighted the risk of UNINSURED large strata complex worth $146,550.000 (evaluation dated 1 September 2022) for two unpaid excesses dated 20 September 2021 and 19 April 2022:

SP52948-insurance-valuation-1Sep2022

SP52948-Waratah-Strata-Management-and-undeclared-expired-insurance-in-FY-2022

Owners' property worth more than $146 millions did not have any insurance cover when insurance policy for SP52948 expired on 21 September 2022, but renewal was delayed for five days and was not published for owners and costs were not included in Income & Expenditure Report even as late as 3 October 2022. No owner was notified about it by committee members or Waratah Strata Management.

Insurance renewal was paid on 26 September 2022, leaving SP52948 uninsured for additional five days (possibly adding to other period since early August 2022), without disclosure to owners. It also created risk of being unable to make any claims in that period, should any incident had happened.

Based on official information published by Waratah Strata Management, owners' property worth more than $146 millions did not have any insurance cover when insurance policy for SP52948 expired on 21 September 2023, but renewal might have been delayed for 20 days and was not published for owners and costs were not included in Income & Expenditure Report even as late as 11 October 2023. No owner was notified about it by committee members or Waratah Strata Management:

SP52948-expired-insurance-on-21Sep2023-not-renewed-as-of-11Oct2023

In agenda for AGM 2023, sent by Waratah Strata Management on 5 October 2023, information about insurance premiums still showed details for previous financial year with expiration date of 21 September 2023:

This was not an accidental mistake, because the same misinformation was repeated on page 81 of the AGM 2023 agenda, showing expired insurance (21 September 2023) on 5 October 2023:

The comparison between agenda for AGM 2022 and 2023 shows same insurance expiration date (21 September 2023), but different sums insured for loss of rent/temp accomodation, additional excesses for water-related claims and all other claims, and different insurance commissions paid to Waratah Strata Management

As predicted by Lot 158, Waratah Strata Management published updated insurance policy 21 days after due date on 12 October 2023, claiming that insurance was paid before due date - on 20 September 2023. This document still did not list all excesses (one drastic example was $10,000.00 excess for each and every water-related damage and exploratory work, introduced by insurance company since 2012 and hidden from owners by strata managers in most years):

SP52948-insurance-due-on-21Sep2023-published-21-days-later-on-12Oct2023

Either Waratah Strata Management ran dubious accounting practices, or had sinister reasons for delaying updates to financial documents, but here is evidence that even as late as 4 October 2023, they did not publish any expenses for insurance renewal, which directly correlated to the fact that agenda for AGM 2023 was published and sent on 5 October 2023, allowing Waratah Strata Management to avoid publishing any information about insurance renewal and still claiming cost of $161,569,59 for September 2022 (GST inclusive) instead of new costs for September 2023:

SP52948-Income-and-Expenditure-Report-1Sep2023-to-4Oct2023

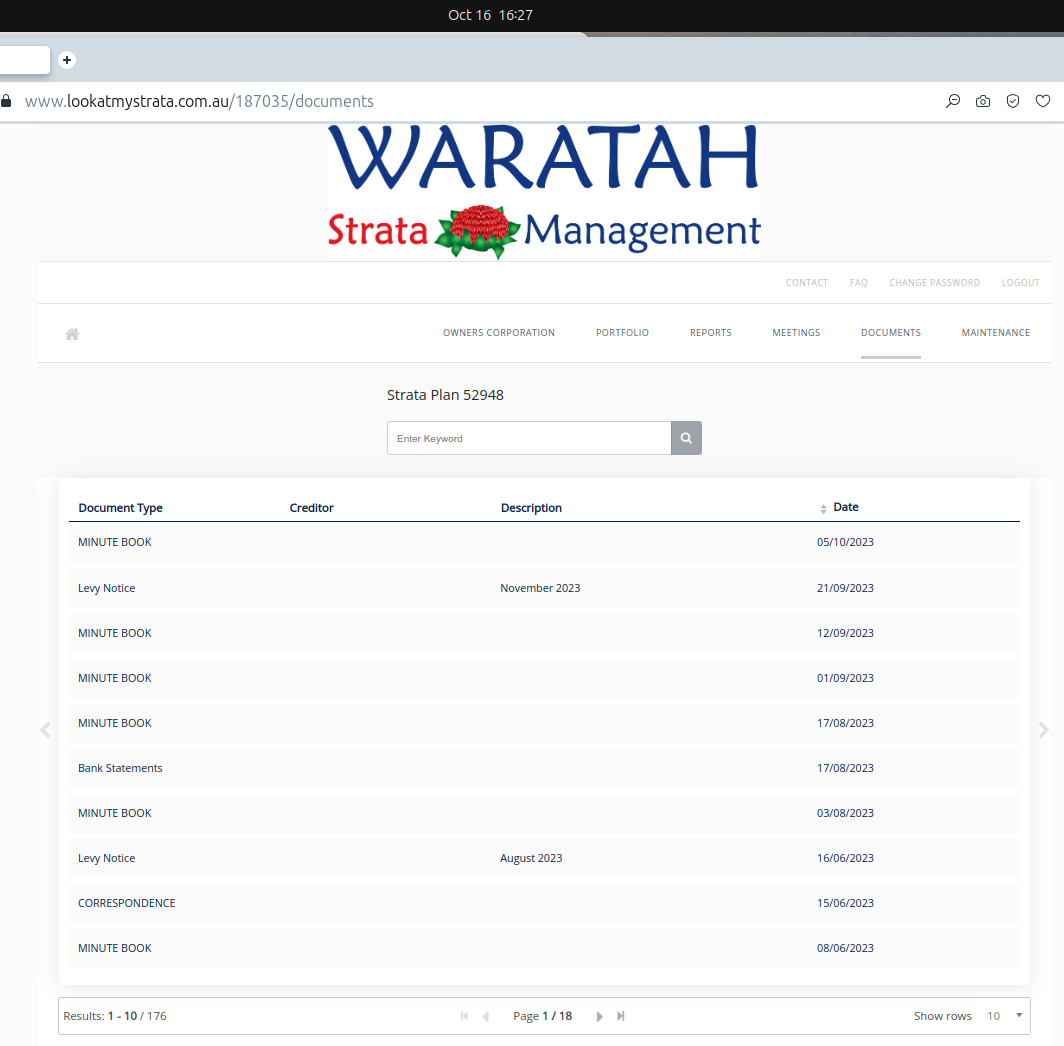

Document folder at Waratah Strata Management website did not disclose insurance policy for owners as of 16 October 2023:

Waratah Strata Management was notified number of times about owners and investors not being informed about full details of insurance policies.

Here is an example of email dated 21 December 2020, where two strata managers failed to respond or take corrective actions. Insurance policy was incomplete, hid details of critical excesses, and did not even have policy number:

Similarly, insurance policy expired on 21 September 2022, but renewal is not published for owners and costs are not included in Income & Expenditure Report dated 22 September 2022. Closing balance in Admin Fund on 22 September 2022 is only $19,498.54 and insurance premiums will be at least $100,000.00 (it does not include costs of possibly unpaid reimbursements to insurance company for alleged legal costs for Solicitor Adrian Mueller in amount of $19,758.14 - on 25 March 2022 Waratah Strata Management listed that revenue from insurance claims in Income & Expenditure Report):

Waratah Strata Management was hiding true status of owners' funds - best shown by Income & Expenditure report dated 3 October 2022, which claimed to have $20,849.04 in Admin Fund whilst insurance premium payment in amount of $161,569.59 (GST inclusive) due on 21 September 2022 was not listed:

Would a reasonable person call this another (repetitive) fraud by Waratah Strata Management in FY 2025:

Waratah Strata Management fraudulent insurance commissions in FY 2025

$23,686.71 paid for insurance commissions to Waratah Strata Management in FY 2025 in spite of advance warning to executive committee to not allow it

On 3 September 2025 Waratah Strata Management made urgent secret request to insurance broker to increase the insurance cover (most probably in accordance with the secret valuation that BIV was asked to do in January 2025 and never disclosed to owners):

SP52948-waratahstrata-Maintenance-folder-secret-insurance-cover-increase-folder-3Sep2025

SP52948-waratahstrata-Maintenance-Open-Work-Orders-folder-3Sep2025

SP52948-waratahstrata-Maintenance-folder-BIV-asked-to-update-insurance-valuation-8Jan2025

On 19 September 2025 Waratah Strata Management published third insurance increase in amount of $10,707.92 (to increase insured property value which was underinsured in March 2025), straight after Lot 158 sent them a stern warning about Bannermans Lawyers non-compliance in NCAT case 2024/00454780 and accompanying risks:

SP52948-Bannermans-Lawyers-non-compliance-and-risks-19Sep2025

SP52948-third-insurance-payment-to-increase-underinsured-property-value-19Sep2025